16 பிப்., 2025 in Porul Economics

Inflation Tax Explained: How It Impacts Your Money & Economy | Porul.in

What is Inflation Tax?

Inflation tax is an implicit tax that happens when the government prints more money, leading to inflation. Inflation tax reduces the purchasing power of money held by the public, effectively transferring wealth from individuals and businesses to the government.

What is Inflation?

Inflation is the rate at which prices for goods and services rise, resulting in a decline of purchasing power over time. When inflation occurs:

- Each unit of currency buys fewer goods.

- Consumer prices generally increase.

- Savings lose value if interest rates don't keep up.

Central banks aim to maintain moderate inflation (typically 2-3% annually) to encourage economic growth.

Mechanism of Inflation Tax

- When governments face fiscal deficits and struggle to raise revenue through taxation or borrowing, they may opt for printing more money.

- This increases the money supply in the economy, leading to inflation.

- As prices rise, the real value of money held by the public declines. This means people can buy less than before with the same amount of money.

Money Supply & Inflation Rate in India (2015-2024)

Understanding the Impact of Inflation Tax

Source: Reserve Bank of India (RBI), World Bank Data

Effects of Inflation Tax

- Redistribution of Wealth: Individuals holding cash or fixed-income assets (like bank savings) suffer, while borrowers benefit as debt loses real value.

- Decline in Real Wages: If wages do not keep up with inflation, workers experience a reduction in real income.

- Erosion of Trust: Persistent inflation can lead to declining confidence in the currency and economic instability.

12 ஜூலை, 2024 in Porul Economics, TNPSC

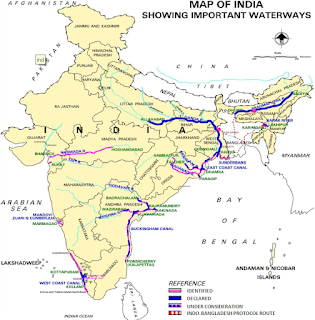

National Waterways - TNPSC

26 செப்., 2022 in Porul Agriculture, Economics

Minimum Support Price (MSP) - UPSC

At the beginning of every sowing season, the Government of India declares Minimum Support Price for 22 crops at which the government purchases from farmers/producers. It gives a guaranteed price and assured market to the farmers by protecting them from Market fluctuations and imperfections.

Minimum Support Price :

Calculation of MSP:

- Cost of Production

- Trends in Market Prices

- Changes in Input prices

- Input-output Price Parity

- Effect on the cost of living

- International price situation

- Demand & Supply

- Effect on issue prices & Implications of subsidy

15 ஏப்., 2022 in Porul Economics, TNPSC, UPSC

What is Account Aggregator Network? - Porul

Recently, India unveiled the Account Aggregator (AA) network, a financial data-sharing system that could revolutionize investing and credit, given the potential pool of customers for lenders and fintech companies.

Account Aggregator

An Account Aggregator (AA) is a type of RBI regulated entity (with an NBFC-AA license) that helps an individual securely and digitally access and share information from one financial institution they have an account with to any other regulated financial institution in the AA network. Data cannot be shared without the consent of the individual. It also gives an Individual to choose an Account Aggregator among many.

What's there for an average person?

Data Security

Way Forward

31 மார்., 2022 in Porul Economics, UPSC

Open Network for Digital Commerce (ONDC) - Porul

Open Network for digital commerce (ONDC) is an open network that enables buyers and sellers to connect digitally across various platforms. It emulates UPI. Here it promotes interoperability across e-commerce applications. To put in simple words if there is a seller in Ecommerce platform A, while a buyer in Ecommerce Platform B. Now what if the buyer in Platform B could see the products of the seller in Platform A. ONDC tries to create this interoperability by acting as a bridge. Hence, transactions can happen through ONDC regardless of the platform.

Gains

What is in for government :

இந்த வலைப்பதிவில் தேடு

Recent posts

- பதிவுகள் ஏற்றப்படுகின்றன...